Methodology Specifications of Iron Ore Portside Index

I. Index Name

Chinese full name: 铁矿石港口现货价格指数

Chinese Abbreviation: 北铁指数

English full name: Iron Ore Portside Index

English Abbreviation: COREX Index

Index Code: IOPI

II. Overview of IOPI

1. Background

With the continuous development of the Chinese iron and steel industry and the profound changes in the global iron ore trade pattern, the iron ore market is growing more demanding of an authoritative and transparent spot price index that reflects the actual trading level.

In recent years, with the evolution of the iron ore circulation model, portside spot trading has become an important part of the Chinese iron ore market, and its activity has been steadily rising. This form of trading possesses notable strengths, including flexible transactions, timely response, pricing that closely aligns with the end-user market, etc. As a result, an increasing number of steel mills and traders choose to complete the procurement and sales in the portside spot market. The price index formed on the basis of the transactions in the Chinese portside spot market can reflect the supply and demand relationship in the spot market in a more timely and more realistic manner.

2. Purpose

Since its establishment in 2012, China Iron Ore Spot Trading Platform (hereinafter referred to as “the Platform”) operated by Beijing Iron Ore Trading Center Corporation (hereinafter referred to as “COREX”) has consistently upheld the principles of independence, openness, and transparency. With a dedicated focus on developing the iron ore spot trading market, the Platform has grown into a leading entity in the industry. COREX has been publishing benchmark prices since its inception, and over the past decade, it has built a deep reservoir of talent and expertise in index compilation and publication, laying a solid foundation for launching the portside price index of iron ore.

To objectively reflect the supply and demand relationship in the iron ore market and promote the development of a scientific and reasonable pricing mechanism, COREX proposes to compile and publish the Iron Ore Portside Index (hereinafter referred to as “IOPI”). On the basis of spot transaction data from Chinese ports, IOPI will be developed through the application of transparent, objective, and scientific methodology specifications in accordance with relevant domestic and international policies and guidelines. With all these efforts, IOPI aims to provide market participants with accurate and reliable information on price index.

III. Index Compilation Approach

1. Reflecting the supply and demand relationship of iron ore with sufficient samples.

Iron ore serves as a vital raw material for the steel industry. IOPI is committed to grounding itself in the supply and demand dynamics of the iron ore portside market by thoroughly collecting samples, seeking to accurately reflect market trends and the central pricing levels.

2. Combining platform information with market information.

Since COREX is an independent third-party iron ore trading platform, IOPI strives to leverage its transparency and make full use of its proprietary data and information from other sources, in order to capture a diverse range of market participants and sampling ports throughout the compilation process.

3. Combining openness with trading volume.

COREX establishes adjustment weights on the basis of the transparency of different types of deals and further refines them according to trading volume to accurately reflect actual market price movements.

4. Combining deals, bids/offers, and market research.

COREX prioritizes the deal data in the compilation of IOPI, particularly the data related to online deals on COREX, while utilizing bids/offers and market research for transition, supplementation, and verification.

5. Combining authenticity verification with outlier elimination.

COREX verifies sample authenticity and employs mechanisms such as outlier elimination to mitigate index fluctuations caused by abnormal prices.

IV. Terms and Definitions

1. Iron ore portside transactions conducted in CNY

The CNY-denominated portside transaction refers to the buying, selling, and delivery of iron ore stored at ports priced in CNY.

2. Base Ports

The base ports in IOPI are the source ports of index samples and the port scope reflected by the IOPI.

3. FOT /WMT (VAT inclusive)

FOT/WMT (VAT inclusive) in IOPI refers to the tax-inclusive amount payable to the sellers after the goods are delivered to the train at the shipping location and loading is completed. This price encompasses VAT and all expenses incurred before loading.

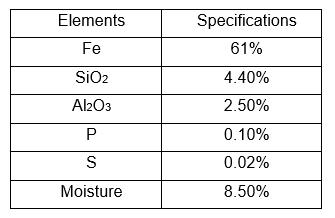

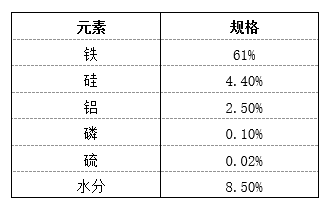

4. Quality Specifications

Quality specifications refer to the content of various elements in iron ore, including iron, moisture, silicon, aluminum, sulfur, phosphorus, and others, and are expressed in percentage (%).

V. Index Basic Settings

1. Index Content

(1) Iron Ore Portside Index (61% Fe Qingdao)

(2) Iron Ore Portside Index (61% Fe Caofeidian)

2. Index Specifications

To ensure that IOPI is reflective of the market, COREX defines the baseline quality specifications on the basis of the portside trading volume and the chemical quality specifications of relevant iron ore brands. Adjustments will be made in response to market changes, as per appropriate established mechanisms.

3. Index Unit

IOPI is compiled on the basis of actual price data from the Chinese portside market. According to prevailing market practices, the unit of IOPI is expressed in RMB per wet metric tonne (FOT, inclusive of VAT), with a minimum price fluctuation of RMB 1/wmt. The unit of corresponding CNY dry metric tonne equivalent price is indicated in RMB/dmt, with a minimum price fluctuation of RMB0.01/dmt. Additionally, the unit of USD dry metric tonne equivalent price is indicated in USD/dmt, with a minimum price fluctuation of USD0.01/dmt.

VI. Sample Collection

1. Sample Types

Data samples refer to the original data used for the compilation of IOPI, including deal samples (COREX deals and offline deals), bids/offers samples (COREX bids/offers), and market research data (other price information).

2. Sample Collection Requirements

COREX determines the sample brands for IOPI through comprehensive assessment of market transaction shares, import volumes, and other relevant factors. The sample brands may be adjusted in line with the relevant mechanisms as market conditions evolve.

The sample brands covered by IOPI include: PB Fines, Mac Fines, Newman Fines, Jimblebar Blend Fines, and BRBF, etc.

According to the pricing details included in IOPI, the base ports are established on the basis of their corresponding regional scope:

Pricing Ports for Iron Ore Portside Index (61% Fe Qingdao): Qingdao Port, with radiating ports including Dongjiakou Port, Rizhao Port, Lanshan Port, and Lanqiao Port.

Pricing Ports for Iron Ore Portside Index (61% Fe Caofeidian): Caofeidian Port, with radiating ports including Jingtang Port, Huanghua Port, and Tianjin Port.

The collection of data samples concludes at 18:00 Beijing time on each index compilation and release day (hereafter referred to as “Index Day”). Samples collected thereafter will be included in the next Index Day.

IOPI only accepts price information based on RMB/wmt (FOT, inclusive of VAT). Minimum quantity for each data sample is at least 2,000 wet metric tonnes, with an iron content between 60% and 63%. Samples that do not fall within this specified range will be excluded.

3. Collection Channels

COREX deal samples and bids/offers samples will be obtained through the Platform. Offline deal samples and market research samples will be collected through channels designated by COREX, such as email and system transfer.

4. Collection Content

Deal samples shall include the following price information: names of both counterparties, product brand, price, iron grade, moisture content, quantity, port, values of impurities such as SiO2, Al2O3, sulfur (S), and phosphorus (P), contracts, and other relevant documents.

Bids/offers samples shall include the following information: name of the declaring enterprise, product brand, price, iron grade, moisture content, quantity, port, and values of impurities such as SiO2, Al2O3, sulfur (S), and phosphorus (P).

COREX will also pay attention to non-quantitative factors that may affect prices included in the payment and delivery methods, such as by barge and clean up, and take them into account during compilation.

COREX will rigorously monitor the quality of price information and implement quality control and verification on the basis of requirements for collected content.

VII. Sample Normalization

1. Quality Normalization

Quality Normalization refers to the process of normalizing data samples to the index’s baseline chemical quality specifications based on the value-in-use (VIU) adjustment values for different quality specifications.

Data samples provided with chemical specifications will be normalized according to its actual quality specifications. If chemical specification is not provided, adjustments will be made based on the typical value of each brand.

COREX determines the baseline quality specifications for each sampling brand on the basis of market information and adjustments may be made in line with the relevant mechanisms as market conditions evolve.

2. Port Normalization

Port Normalization is the process of normalizing sample prices from various ports within a region based on port differentials, using the two base ports as foundation.

COREX calculates the current week’s port differentials on the basis of the price information at ports from the previous week. If data from a specific port is insufficient to support the calculation, the latest available value will be carried forward.

3. Outlier Adjustment

COREX will identify outliers in the normalized data samples through the following steps:

(1) Verify the data for any entry errors and correct them if present.

(2) Check for any clauses that may affect prices or abnormal quotation behaviors and exclude the affected data samples if present.

(3) Data samples processed through the above two steps will be subjected to mathematical screening together with data samples where no abnormalities have been detected. Standardized prices that deviate significantly from market levels will be identified as outliers and excluded.

VIII. Index Compilation Process

1. Weighted Calculation

IOPI prioritizes platform trading information and assigns different weights to various types of samples on the basis of the transparency of price data, trading volume weighting mechanism that calculates sample trading volumes according to established weight standards.

When market trading activity is low, or when there are no deal or bids/offers samples for any iron ore brands, COREX will supplement the day’s data samples through market research to support index compilation.

2. Price Equivalence Calculation

Based on the iron ore portside index, COREX will calculate its price equivalence in both CNY dry metric tonne and USD dry metric tonne.

The price equivalence CNY dry metric tonne reflects the price exclusive of the effects of moisture.

The price equivalence in USD dry metric tonne is the USD price adjusted for port fees, moisture content, VAT, and the USD-CNY exchange rate.

3. Concentration Judgment and Response Mechanism

COREX has established response plans to address situations where data samples are insufficient, unreliable, or anomalous, thereby ensuring the quality and consistency of index compilation.

In cases where deal samples are insufficient, resulting in market data from a single entity exceeding 2/3 of the total number of sample data, COREX will expand the collection channels for deal data to reduce data source concentration. Should the imbalance in individual sample proportions persist despite enhanced data collection efforts, supplementary market research information, including other deal data, tradable prices, bids and offers, will be incorporated.

IX. Index Release

1. Index Day

Index Days are determined on the basis of the official working days announced by the Chinese government.

COREX will publish the index release calendar for the upcoming year in December and disclose it to the market through public channels.

2. Release Content and Related Regulations

Release time: IOPI will be released after calculation and necessary internal control procedures on each Index Day.

In case of emergencies, IOPI will be released promptly upon the completion of compilation process, and a notice will be issued as necessary to explain the relevant situation.

Iron Ore Portside Index, along with its equivalence in CNY and USD per dry metric tonne, will be published on COREX’s official website and other designated channels on each Index Day.

3. Error Correction

If an error is identified in the officially released index, COREX will promptly implement corrections and issue a public notice in a prominent manner.

X. Expert Committee

1. Establishment of an Expert Committee

Given the non-standardized nature of iron ore, COREX has established an index expert committee comprised of industry companies and organizations to support the index compilation process, ensuring the index fully and accurately reflects market conditions.

2. Expert Committee Responsibilities

(1) Members of the expert committee may provide recommendations for the VIU adjustment values used for the compilation of the index based on market conditions. The recommendations shall be provided through COREX’s designated channels and will be processed in accordance with the relevant regulations by COREX.

(2) Members of the expert committee may propose their adjustment recommendations on the methodology specification according to the observed market changes. COREX will evaluate these recommendations, and reply will be provided to the relevant committee members.

3. Expert Committee Survey Data Processing Principles

COREX assigns equal weight to the data provided by expert committee members. When data samples are sufficient, COREX will calculate a data after excluding any outliers.

XI. Index Operation Guarantee Mechanism

1. Index Compilation Personnel Management

COREX has developed a comprehensive management system for index compilation personnel that encompasses selection, training, and assessment.

The selection process strictly adheres to COREX’s internal regulations, which requires candidates to possess relevant industry experience and to pass COREX’s assessment.

COREX has designed training programs of regular index compilation and release. It will also conduct regular phased assessments to evaluate the professional competence of index compilation personnel.

COREX has formulated a succession plan and a dynamic personnel management system of the index compilation personnel. It will regularly update and maintain the list of index compilation staff.

2. Data Provision Management

To ensure the authenticity, accuracy, and completeness of sample data, COREX has established “Measures for the Data Provision”, which includes the management of data providers, data provision, and data usage.

COREX confirms the details of the aforementioned management system with data providers annually.

3. Changes to Methodology Specifications

COREX will assess the adequacy, and distribution of index samples, as well as the relevance of the index methodology to market conditions on regular basis, to determine if it is necessary to revise the methodology specifications. If deemed necessary, the index compilation team will make the appropriate revisions according to the evaluation results.

Any revisions that lead to significant changes in the index will be classified as major changes. To ensure the continuity and integrity of the index, COREX has developed a robust internal control mechanism which guarantees that changes are implemented to enable the index to reflect market prices more accurately. Announcements of major changes will be issued in advance on COREX’s official website and trading system, and feedback will be actively solicited regarding the procedures or methods involved in these changes.

4. Conflict of Interest

COREX has established “Measures for Conflicts of Interest” to prevent conflicts of interest from affecting the objectivity, fairness, and credibility of the index.

The “Measures for Conflicts of Interest” outlines potential conflict of interest scenarios, corresponding management measures, and specifies requirements for recording, supervision, and disclosure.

5. Complaint Management

COREX has implemented “Measures for Enquiries and Complaints”, which clearly outlines channels for external enquiries and complaints as well as the corresponding handling procedures. COREX will actively respond to the feedback and suggestions from relevant parties. The personnel responsible for handling complaints operate independently from the index compilation team.

The “Measures for Enquiries and Complaints” will be disclosed on COREX’s official website.

6. Audit Trail

COREX has implemented strict internal control measures to oversee the collection and transmission of data, the details of which, including the identities of the personnel involved in index compilation, judgment records, the reasons and results of data screening, and the internal approval of evaluation procedures are meticulously recorded.

COREX has established a data standard system to regulate the process of data usage, correction and deletion. The system aims to prevent improper handling, elimination or modification of data based on personal judgments.

COREX will conduct regular internal reviews of the index and its development, compilation, and release processes to ensure their rationality and compliance.

7. Information Preservation

COREX preserves relevant information related to the index, including price collection, data screening, personnel identification, and judgment records, for at least five years in the form of system logs, email, internal official document messages, meeting minutes, account books, etc.

8. Compliance Assessment

IOPI is in strict accordance with the “Administrative Measures for the Behavior of Important Commodity and Service Price Indices” (Decree No. 22 of the National Development and Reform Commission, 2024). It is subject to supervisions from all stakeholders and is governed by a robust governance framework and institutional constraints.

An annual self-evaluation of IOPI will be conducted since the date of its release. An additional independent professional organization will be engaged to carry out a third-party evaluation when necessary. The evaluation process will adhere to the principles of independence, objectivity, and confidentiality, with the main content and results of the evaluation disclosed as appropriate.

XII. Supplementary Provisions

1. Interpretation and Revision

COREX reserves the rights to interpret and revise this methodology specification.

The methodology specification and relevant policies are available on COREX’s official website and other designated channels.

2. Effective Date

This methodology specification shall enter into force as of the date of promulgation.

3. Both Chinese and English versions are valid. In case of any inconsistency, the Chinese version shall prevail.

铁矿石港口现货价格指数编制方案

一、指数名称

中文全称:铁矿石港口现货价格指数

中文简称:北铁指数

英文全称:Iron Ore Portside Index

英文简称:COREX Index

指数编码:IOPI

二、编制概况

(一)编制背景

随着我国钢铁工业的持续发展以及全球铁矿石贸易格局的深刻变化,市场对权威、透明、反映真实交易水平的铁矿石现货价格指数的需求日益增长。

近年来,随着铁矿石流通模式的演变,港口现货贸易已成为我国铁矿石市场的重要组成部分,交易活跃度持续攀升。港口现货交易具有成交灵活、反应及时、价格贴近终端市场等优势,越来越多的钢厂和贸易商选择在港口现货市场完成采购与销售。基于中国港口现货市场交易形成的价格指数更能及时、真实地反映即期现货市场的供需关系。

(二)编制目的

北京铁矿石交易中心股份有限公司(以下简称“北铁中心”)运营的中国铁矿石现货交易平台(以下简称“平台”)自2012年成立以来,始终秉持独立、开放、透明的运营理念,专注于深耕铁矿石现货交易市场,已成为行业领先的铁矿石现货交易平台。同时,北铁中心自平台成立起开始发布基准价,逾10年间在指数编制及发布领域积累了丰富的人才和经验,为推出铁矿石港口现货价格指数奠定了坚实基础。

为客观反映铁矿石市场供需关系,推动建立科学合理的定价机制,北铁中心拟编制、发布铁矿石港口现货价格指数(以下简称“本指数”),以中国港口现货交易数据为样本,按照国内外相关政策、准则和更加透明、客观、科学的方法进行编制,为市场参与者提供真实、可靠的价格指数信息。

三、指数编制思路

(一)以充足样本反映铁矿石的供求关系。铁矿石是钢铁行业重要的生产原料,本指数坚持立足于铁矿石港口现货市场供求关系,充分采集样本,力求真实反映市场价格的运行方向及中枢水平。

(二)平台信息与市场信息相结合。本指数力求充分发挥北铁中心作为独立第三方的铁矿石交易平台的透明度优势,在编制过程中充分使用平台信息,并辅以其他渠道信息,力争覆盖各类市场参与者和各采样港口。

(三)公开度与交易量相结合。北铁中心根据各类交易的公开性设立调整权重,同时辅以交易数量加权,真实反映市场价格运行情况。

(四)成交、申报与市场调研相结合。北铁中心在编制中优先采用交易数据,尤其是在北铁中心发生的线上交易,另采用申报、市场调研作为过渡、补充和校验。

(五)真实性核验与异常值剔除相结合。北铁中心对样本进行真实性核验,通过异常值剔除等机制,避免少数特殊价格引起指数异常波动。

四、术语定义

(一)铁矿石港口人民币交易。港口人民币交易指以在港口存放的铁矿石为交易标的,基于人民币定价,进行交易和交付的贸易行为。

(二)采样港口。本指数所称采样港口,是指数样本的来源港口及指数反映的港口范围。

(三)湿吨含税车板价。本指数所称湿吨含税车板价,是指卖方将货物送达发运地火车并完成装运后的含税价格,包含增值税及装车前所有费用。

(四)元素指标。本指数所称元素指标,是指铁矿石中各元素含量,包括铁含量、水分含量、硅含量、铝含量、硫含量、磷含量等,均以百分数(%)表示。

五、指数基础设定

(一)指数内容

1.铁矿石港口现货价格指数(61% 青岛港)

2.铁矿石港口现货价格指数(61% 曹妃甸港)

(二)指数规格

为保障本指数的市场代表性,北铁中心根据相关铁矿石品种港口现货交易量及元素含量设定本指数元素规格。如市场情况发生变化,将按相应机制进行调整。

(三)指数单位

本指数基于中国港口现货市场真实价格数据编制形成,根据市场交易习惯,本指数单位为元/湿吨、含税车板价,最小价格变动单位为1元/湿吨;同步发布的人民币干吨折算价单位为元/干吨,最小价格变动单位为0.01元/干吨,美元干吨折算价单位为美元/干吨,最小价格变动单位为0.01美元/干吨。

六、样本采集

(一)样本类型

数据样本是指用于编制本指数的原始数据,包括成交类样本(北铁中心成交、线下成交)、申报类样本(北铁中心申报)、市场调研数据(其他价格信息)。

(二)采集要求

北铁中心综合考虑市场交易占比、进口量等因素,确定港口现货价格指数采样品种,并根据市场情况变化按相应机制对采样品种进行调整。

本指数采样品种范围:PB粉、麦克粉、纽曼粉、金布巴混合粉、BRBF等。

根据本指数包含的价格内容,按所反映的区域范围设定采样港口:

铁矿石港口现货价格指数(61% 青岛港)基准港:青岛港;辐射港口:董家口港、日照港、岚山港、岚桥港。

铁矿石港口现货价格指数(61% 曹妃甸港)基准港:曹妃甸港;辐射港口:京唐港、黄骅港、天津港。

数据样本采集截止时间为每指数编制及发布日(以下简称“指数日”)北京时间18:00,该截止时间后采集的数据样本将被纳入下一指数日。

本指数的价格信息只采用以人民币计价的湿吨含税车板价。每个数据样本最少为2,000湿吨,含铁量在60%-63%,不符合要求范围的样本将被排除。

(三)采集渠道

北铁中心成交、申报数据样本将通过平台获取。线下成交、市场调研数据样本将通过电子邮件、系统对接等北铁中心指定的渠道进行采集。

(四)采集内容

成交类样本的价格信息包括:成交双方企业名称、货物的品种名称、价格、铁品位、水分、数量、港口、SiO2、AL2O3、S、P等杂质的含量、合同等相关文件。

申报类样本的信息包括:申报方企业名称、货物的品种名称、价格、铁品位、水分、数量、港口、SiO2、AL2O3、S、P等杂质的含量。

北铁中心也将了解付款方式、提货方式中包含的如转水、清底等其他可能影响价格的非量化因素,并在编制时作为考虑因素。

北铁中心将严格把控价格信息的质量,并通过对采集内容的要求进行质量控制及验真。

七、样本标准化

(一)品质标准化

品质标准化是指按照元素调整值将数据样本标准化为指数元素标准的过程。

当采集到的数据样本含元素指标时,以实际指标进行折算和元素调整,无元素指标时,按照各品种基准值进行调整。

北铁中心依据市场信息设定各采样品种基准值,并根据市场情况变化按相应机制进行调整。

(二)港口标准化

港口标准化是指以两个区域基准港为基础,把各港口区域内的数据样本价格按港差进行调整的过程。

北铁中心根据前一周的价格信息确定当周港差调整值,若某一港口前一周数据不能支撑计算,则沿用前值。

(三)异常值处理

北铁中心将按以下步骤对数据样本标准化处理后的结果进行异常值判断:

1.确认是否存在数据录入错误,如有误,进行修正。

2.确认是否包含可能影响价格的条款或异常申报行为,如存在,排除该数据样本。

3.将通过以上两步处理后的数据样本与未发现异常的数据样本统一进行数理筛选,标准化价格明显偏离市场水平将被认定为异常值予以排除。

八、指数编制流程

(一)加权计算

本指数优先使用平台交易信息,并根据价格信息的公开性对各类型样本设置不同的调整权重,辅以交易数量加权机制,根据权重标准对样本交易量进行加权计算。

当市场交易活跃度低或所有品种均无成交类样本和申报类样本时,北铁中心将通过市场调研补充当日数据样本,支撑指数编制。

(二)折算价计算

基于铁矿石港口现货价格指数,北铁中心将同步计算其人民币干吨折算价及美元干吨折算价。

人民币干吨折算价为剔除水分影响后的价格。

美元干吨折算价为对港杂费、水分、增值税、美元兑人民币汇率进行处理后的美元价格。

(三)集中度判断及应对机制

北铁中心针对数据样本不充分、不可靠或存在异常的情况建立了相应的应对预案,以保证指数编制的质量和持续性。

如成交样本不充分,导致来自某个主体的市场数据占样本总数据比例超过2/3时,将进一步扩大成交数据收集渠道,以降低数据来源集中度。若无法通过强化成交数据收集来缓释单个样本占比失衡问题,将辅以市场调研的其他成交信息、可成交价格、询盘和报盘数据。

九、指数发布

(一)指数日

指数日按国家发布的法定工作日执行。

北铁中心将于每年12月发布次年指数发布日历,并于公开渠道向市场披露。

(二)发布内容及相关规定

发布时间:每指数日完成指数计算,并履行必要的内控流程后发布。

如遇突发事件影响,指数将在完成编制流程后及时发布,并按需发布公告就相关情况予以说明。

每指数日通过北铁中心官方网站及指定的其他渠道发布铁矿石港口现货价格指数,及基于该指数计算得出的人民币干吨折算价及美元干吨折算价。

(三)错误修正

如发现已正式对外发布的指数存在错误,北铁中心将及时更正,并在显著位置予以公告。

十、专家委员会

(一)专家委员会设置

考虑到铁矿石非标化的品种特征,为保证指数充分、准确反映市场现状,北铁中心采用由行业企业或组织组成的指数专家委员会为指数编制提供支撑。

(二)专家委员会职责

1.专委会成员为指数编制过程中的品质标准化调整值等提供参考依据,并根据观察到的市场情况列示调整意见,通过指数编制团队的指定渠道反映至北铁中心,北铁中心将按相关要求进行处理。

2.专委会成员可根据市场情况变化,对指数编制方案提出调整建议,北铁中心评估后决定是否调整,并向相关成员做出回复。

(三)专家委员会数据处理原则

北铁中心对专委会成员提供的数据设置同等权重,在数据样本数量较为充分时,北铁中心将在剔除离群值后对剩余数据进行处理。

十一、指数运行保障机制

(一)指数编制人员管理

北铁中心对指数编制人员建立了覆盖选拔、培训与考核的全周期管理体系。

指数编制人员的选拔严格遵循北铁中心内部规章,要求具备一定的行业经验,并通过北铁中心考核认证。

北铁中心就日常指数编制发布制定了培训计划,并定期对指数编制人员开展专业能力的阶段性考核。

北铁中心建立了指数编制人员继任计划与动态管理机制,并定期维护指数编制人员清单。

(二)数据提供管理

为保障数据样本的真实性、准确性和完整性,北铁中心建立了数据提供管理办法,内容包括数据提供方的管理、数据提供的管理、以及数据使用的管理等。

北铁中心每年与数据提供方确认办法内容。

(三)编制方案变更

北铁中心定期就指数编制方案对市场的适用性、指数样本的充分性与分布等情况开展评估,评价是否有必要对编制方案进行调整。经评估认为指数编制方案确需修订的,由指数编制团队根据评估结果对编制方案进行必要调整。

修订方案使指数产生实质性变化的,认定为重大变更。对此,北铁中心建立了审慎的内部控制流程,以确保指数的持续性、完整性,并确保实施变化是为了保障指数可更真实地反映市场价格。重大变更将于北铁中心官网及交易系统提前公告,并就变更的程序或方法广泛征求意见。

(四)利益冲突

北铁中心建立了利益冲突管理办法,防范因利益冲突影响指数的客观性、公允性及公信力。

利益冲突管理办法明确可能的利益冲突场景、对应管理措施及记录、监督与披露要求。

(五)投诉管理

北铁中心建立了指数咨询与投诉管理办法,明确了外部咨询与投诉渠道及处理流程,并将积极回应相关方的意见建议。投诉处理人员独立于指数编制团队。

指数咨询与投诉管理办法通过北铁中心官网进行披露。

(六)审计追踪

北铁中心建立了严格的内部控制措施,对数据采集、传输过程进行管理,并对指数编制人员身份、判断记录、数据筛选理由及结果、评估程序内部签批等过程细节进行详细记录。

北铁中心制定了数据标准体系,规范数据的使用、修正、删除流程,避免以个人经验违规处理、剔除、修改数据的情形。

北铁中心内部定期检查指数研发、编制流程、指数发布过程和结果的合理性、合规性。

(七)信息保存

北铁中心通过系统日志、来往邮件、内部公文系统消息、会议纪要、台账等形式,对涉及指数的相关信息,包括价格采集、数据筛选、人员身份、判断记录等保存至少五年。

(八)合规评估

本指数严格遵循《重要商品和服务价格指数行为管理办法》(国家发展改革委令 2024 年第 22 号),接受各方监督,并从治理架构、制度约束等方面进行严格约束。

本指数自发布之日起,每年对指数进行自评,必要时委托独立专业机构开展第三方评估,评估过程秉承独立、客观和保密原则,并以适当方式披露评估主要内容和结果。

十二、 附则

(一)解释与修订

本编制方案由北铁中心负责解释和修订。

编制方案及相关制度规范于北铁中心官网及其他指定渠道披露。

(二)生效日期

本编制方案自发布之日起实施。